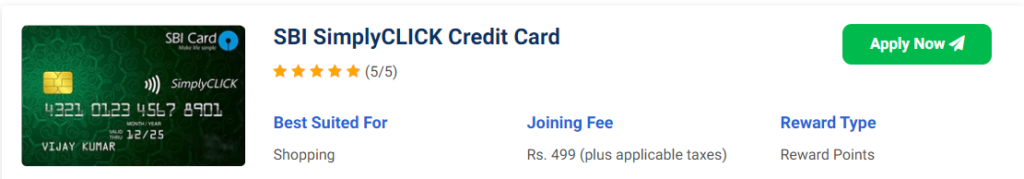

The SBI SimplyCLICK Credit Card, offered by SBI Card, is a shopping credit card targeted towards entry-level customers. It has gained popularity among first-time cardholders and is considered one of the top choices in its segment. The card’s primary focus is online shopping, as it offers a high reward rate of 2.5% at popular shopping and travel websites like Cleartrip, Apollo24x7, Netmeds, BookMyShow, Dineout, and Lenskart. Previously, Amazon was also included in the 10x rewards program, but it has since been replaced with a 5x rewards rate.

For other online and offline transactions, the card provides a reward rate of 1.25% and 0.25%, respectively. With an annual membership fee of only Rs. 499, the SimplyCLICK SBI Card does not offer any premium lifestyle benefits related to travel, dining, or movies that are typically available with high-end credit cards. However, customers have the opportunity to earn gift vouchers worth up to Rs. 4,000 each year by reaching the required spending milestones. To learn more about the SBI SimplyCLICK Credit Card, keep reading.

Table of Contents

Product Details

The SBI SimplyClick Credit Card offers several benefits, including a welcome gift of Amazon gift vouchers worth Rs. 500. Additionally, customers can earn e-vouchers from ClearTrip worth Rs. 2,000 for net annual spending of Rs. 1,00,000 and Rs. 2,00,000 each.

The card also provides 10X reward points on online spending at partner merchants, such as Amazon, BookMyShow, Apollo24x7, and others. For all other online transactions, customers can earn 5X reward points. When it comes to offline spends, customers can earn 1 reward point for every Rs. 100 spent, excluding fuel purchases.

Customers who spend Rs. 1,00,000 or more annually can also enjoy an annual fee waiver of Rs. 499. Finally, the SBI SimplyClick Credit Card provides a waiver of 1% fuel surcharge for all fuel purchases between Rs. 500 and Rs. 3,000.

SBI SimplyClick Credit Card Rewards and Benefits

- Welcome Benefits

- Upon paying the annual fees, customers can receive a welcome benefit of an Amazon e-voucher worth Rs. 500.

- Rewards Rate

- The card offers a reward rate of 0.25% with 1 Reward Point awarded for every Rs. 100 spent on offline transactions. For online spends at partner merchants, such as BookMyShow and Apollo24x7, customers can earn a reward rate of 2.5% with 10X Reward Points. For all other online transactions, customers can earn a reward rate of 1.25% with 5X Reward Points.

- Reward Redemption

- Customers can redeem their Reward Points for gift vouchers on sbicard.com or through the SBI mobile app. They can also use their Reward Points to pay off their outstanding balance. The conversion rate is 1 Reward Point to Rs. 0.25.

- Zero Liability Protection

- Cardholders are provided with zero liability protection in case of a lost or stolen card, provided that they inform the bank officials promptly about the loss.

Fees & Charges

- Joining Fee

- Rs. 499 (plus applicable taxes)

- Rewards Redemption Fee

- Rs. 99 (plus taxes) on each redemption request

- Fuel Surcharge

- 1% fuel surcharge waived on fuel transactions from Rs. 500 to Rs. 3,000 (max waiver capped at Rs. 100 per month)

- Renewal Fee

- Rs. 499 + GST

- Foreign Currency Markup

- 3.5% of the total transaction amount

- Cash Advance Charge

- 2.5% of the withdrawal amount or a minimum fee of Rs. 500

- Spend based Waiver

- Get a renewal fee waiver on achieving total annual spends of Rs. 1 lakh in previous year.

- Interest Rates

- 3.5% per month or 42% annualized

- Add-on Card Fee

- Nil

SBI SimplyCLICK Credit Card Features & Benefits

The SBI Simply Click Credit Card is a highly sought-after credit card due to its simplicity and numerous benefits. It offers a range of exciting features, including a welcome bonus, reward programs, and milestone benefits. Below are the benefits and features of this credit card:

Welcome Benefits:

Upon payment of the card membership fee, customers can receive a welcome gift in the form of an Amazon gift voucher worth Rs. 500. The voucher code will be sent to the customer’s registered mobile number within 30 days of payment of the joining fee. The gift voucher will be valid for 12 months from the date of accrual.

SBI SimplyCLICK Credit Card Milestone Benefits:

Customers can receive an e-voucher valued at Rs. 2,000 from ClearTrip upon achieving annual spends of Rs. 1 lakh with the card. Additionally, another e-voucher valued at Rs. 2,000 from ClearTrip can be earned upon achieving annual spends of Rs. 2 lakh with the card. Furthermore, the renewal membership fee can be waived for cardholders who have achieved annual spends of Rs. 1 lakh in the previous year.

SBI SimplyCLICK Credit Card Fuel Surcharge Waiver:

Customers can enjoy a waiver of the 1% fuel surcharge for transactions made at all fuel filling stations across India for transaction values between Rs. 500 and Rs. 3,000, with a maximum benefit of Rs. 100 per month.

SBI SimplyCLICK Credit Card Zero Liability Protection

The SBI Card offers zero liability protection with the Simply Click Card. This means that if the card is reported lost or stolen to the card issuer in a timely manner, the cardholder will not be liable for any unauthorized or fraudulent transactions made through the card.

SimplyCLICK SBI Credit Card Rewards:

- For every Rs. 100 spent with the card on offline spends, the cardholder earns 1 Reward Point, which equates to a reward rate of 0.25%.

- When making online purchases at partner merchants like Cleartrip, BookMyShow, Dineout, Lenskart, Apollo24x7, and Netmeds, the SBI SimplyCLICK Credit Card offers 10X Reward Points, or 10 Points per Rs. 100 spent, resulting in a reward rate of 2.5%. It’s important to note that this benefit is not applicable for gift card purchases, utility bill payments, and recharge on Amazon.

- The card provides a reward rate of 1.25% in the form of 5X reward points on all other online spends made using the card.

- The maximum limit of earning Bonus Reward Points (at 5X or 10X rate) on online transactions with the card is 10,000 Reward Points per month.

Redeeming Reward Points:

To redeem the Reward Points earned through your SimplyCLICK SBI Credit Card, you need to log in to sbicard.com. You can use your earned points to avail of various products and gift vouchers available in SBI Card’s reward catalogue at the rate of 1 Reward Point = Re. 0.25. You can also redeem your reward points to pay off your card’s outstanding balance. Here’s a step-by-step guide on how to redeem your SimplyClick SBI Card Reward Points

- Go to the SBI Card’s official website.

- Click on the option ‘Rewards.’

- On your screen, you will be able to view a variety of products.

- Click on the product for which you wish to redeem your points.

- If you wish to purchase the product using only your points, select the ‘Points Only’ option. However, if you want to pay for the product partially with your points and the remaining amount with cash, select the ‘Points + Pay’ option.

- Proceed to redeem your points by logging in with your registered mobile number or card details.

To utilize your reward points to pay off your statement balance, you can either reach out to the credit card customer care or follow these simple steps

- Log in to sbicard.com.

- From the main menu, select Mailbox.

- Select “Reward Points Redemption” from the category options.

- Select the ‘Request for redemption’ option under the appropriate sub-category and follow the prompts to send an email.

SBI SimplyCLICK Credit Card Fees and Charges

Each credit card is equipped with a unique set of features and terms and conditions that encompass reward programs, various charges such as annual fees, interest rates, cash advance fees, and other similar aspects. Below are the fees and charges associated with the Simply Click SBI Card:

- To own the Simply Click Credit Card, an annual fee of Rs. 499 plus applicable taxes is applicable. However, you can get the annual fee waived off starting from the second year by spending Rs. 1 lakh or more in the previous anniversary year.

- The credit card bears an interest rate of 3.5% per month, equivalent to 42% per annum.

- When you make a transaction in a foreign currency using your SBI Credit Card, a foreign currency markup fee of 3.5% of the total transaction amount is charged on the SimplyCLICK SBI Credit Card.

- If you withdraw cash using the SBI Simply Click Credit Card, a cash advance fee of 2.5% of the transaction amount, with a minimum of Rs. 500, will be charged.

SBI Simply CLICK Credit Card Eligibility Criteria

To obtain approval for a particular credit card, an applicant must meet the eligibility criteria specific to that card. Your age, income, and credit score are the primary factors that determine your eligibility for a credit card. Below is the eligibility criteria for the SimplyCLICK SBI Credit Card:

| Criteria | Age | Income |

| Salaried | 18 years – 65 years | Rs. 20,000 per month |

| Self-employed | Self-employed | Rs. 20,000 per month (as per ITR) |

Documents Required

When applying for the Simply Click SBI Card, you will need to provide or upload the following documents:

- Identity Proof – Aadhar card, PAN Card, Voters’ Id, Passport, Driving License, or any government-approved Id.

- Address Proof – Aadhar Card, Utility Bills, Ration Card, Passport, etc.

- Income Proof – latest 3 months’ salary slips, latest 3 months’ bank statement, or latest audited financial report.

How To Apply For SBI Simply Click Credit Card Online?

he Simply Click SBI Card can be applied for either online or offline, depending on your preference. If you prefer to apply offline, you will need to visit your nearest SBI branch and complete a physical application form for the Simply Click Card. Alternatively, if you prefer to apply online, you can follow a few straightforward steps, which are outlined below:

- Visit the official website of SBI Card.

- Navigate to the “Credit Cards” section and select “Simply Click” from the list of available cards.

- Click on the “Apply Now” button.

- Fill in the application form with your personal, employment, and contact details.

- Provide the necessary documents, such as identity proof, address proof, and income proof.

- Review the information you have entered and submit the application.

- Once your application is approved, your card will be dispatched to your registered address.

You can also track the status of your application online by logging into your SBI Card account or by contacting the SBI Card customer service.

You can check the status of your SBI SimplyCLICK Credit Card application online by following the steps given below:

- Visit the official website of SBI Card.

- Click on the “Track Your Application” option at the top right corner of the webpage.

- Enter your Application Reference Number (ARN) or your 16-digit application number, along with your registered mobile number or date of birth.

- Click on the “Track” button to view the status of your application.

Alternatively, you can also check the status of your application by calling the SBI Card customer care number and providing your application details. You can find the customer care number on the SBI Card website or on the back of your credit card.

SimplyCLICK Credit Card apply online

SBI Simply CLICK Credit Card Activation & PIN Generation

- Dial the SBI Card customer care number from your registered mobile number. You can find the number on the back of your credit card or on the SBI Card website.

- Choose the option for credit card activation from the IVR menu.

- Enter your credit card number, followed by the CVV and the expiry date when prompted.

- Next, you will be asked to set a 4-digit PIN for your credit card.

- Once you have entered the PIN, it will be confirmed, and your card will be activated.

Alternatively, you can activate your card and generate your PIN by visiting any SBI ATM. Insert your credit card, select the “PIN Generation” option, and follow the instructions on the screen to complete the process.

SimplyCLICK Credit Card apply online

SBI Simply Click Credit Card Limit

The credit limit on your SBI Simply Click Credit Card is determined by SBI Card based on various factors such as your credit score, credit history, income, and other eligibility criteria. Your credit limit may vary depending on these factors and may be subject to change based on your usage and payment behavior.

To check your current credit limit, you can log in to your SBI Card account online or through the SBI Card mobile app. You can also contact the SBI Card customer care to know your credit limit or to request a credit limit increase. It is important to use your credit card responsibly and within your credit limit to avoid exceeding it and incurring penalties or interest charges.

SimplyCLICK Credit Card apply online

SBI Simply Click Card Customer Care

If you have any queries or issues related to your SBI Simply Click Credit Card, you can contact the SBI Card customer care through any of the following channels:

- Customer Care Number: You can call the SBI Card customer care number at 39 02 02 02 (prefix local STD code) or 1860 180 1290 (toll-free) from your registered mobile number. The customer care executives are available 24×7 to assist you with your queries.

- Email Support: You can also send an email to the SBI Card customer care at customer.care@sbicard.com with your query or concern, and they will get back to you with a resolution as soon as possible.

- Live Chat: You can initiate a live chat with the SBI Card customer care executive through the SBI Card website or mobile app for quick assistance.

- Social Media: You can also reach out to SBI Card through their social media handles like Facebook and Twitter for any queries or concerns related to your credit card.

It is recommended to keep your SBI Simply Click Credit Card details handy while contacting the customer care for faster assistance.

SimplyCLICK Credit Card apply online

Conclusion

The SBI SimplyCLICK Credit Card is an excellent credit card for young millennials who frequently shop online, especially at partner merchants. It offers attractive rewards and accelerated reward points on online shopping, making it highly beneficial for frequent online shoppers. Additionally, the low annual fee of just Rs. 499 per year makes it an excellent choice for first-time cardholders.

If you’re looking for a credit card that can make your shopping experiences more rewarding, the SBI SimplyCLICK Credit Card is definitely worth considering. However, before applying, it’s important to check the eligibility criteria to ensure you meet the requirements.

If you’re already a cardholder, feel free to share your experience in the comments section to help others make an informed decision. We would love to hear your thoughts on this entry-level offering by SBI Card.